Since 2010

DLF Privana: Delhi NCR’s Next Big Township Triumph?

DLF Privana: Delhi NCR’s Next Big Township Triumph?

Since 2010

Key Takeaways!

- DLF’s Unmatched Legacy: With 75 years of iconic projects like DLF5 and Cyber City, DLF Limited brings trust and excellence to Privana’s 116-acre township vision.

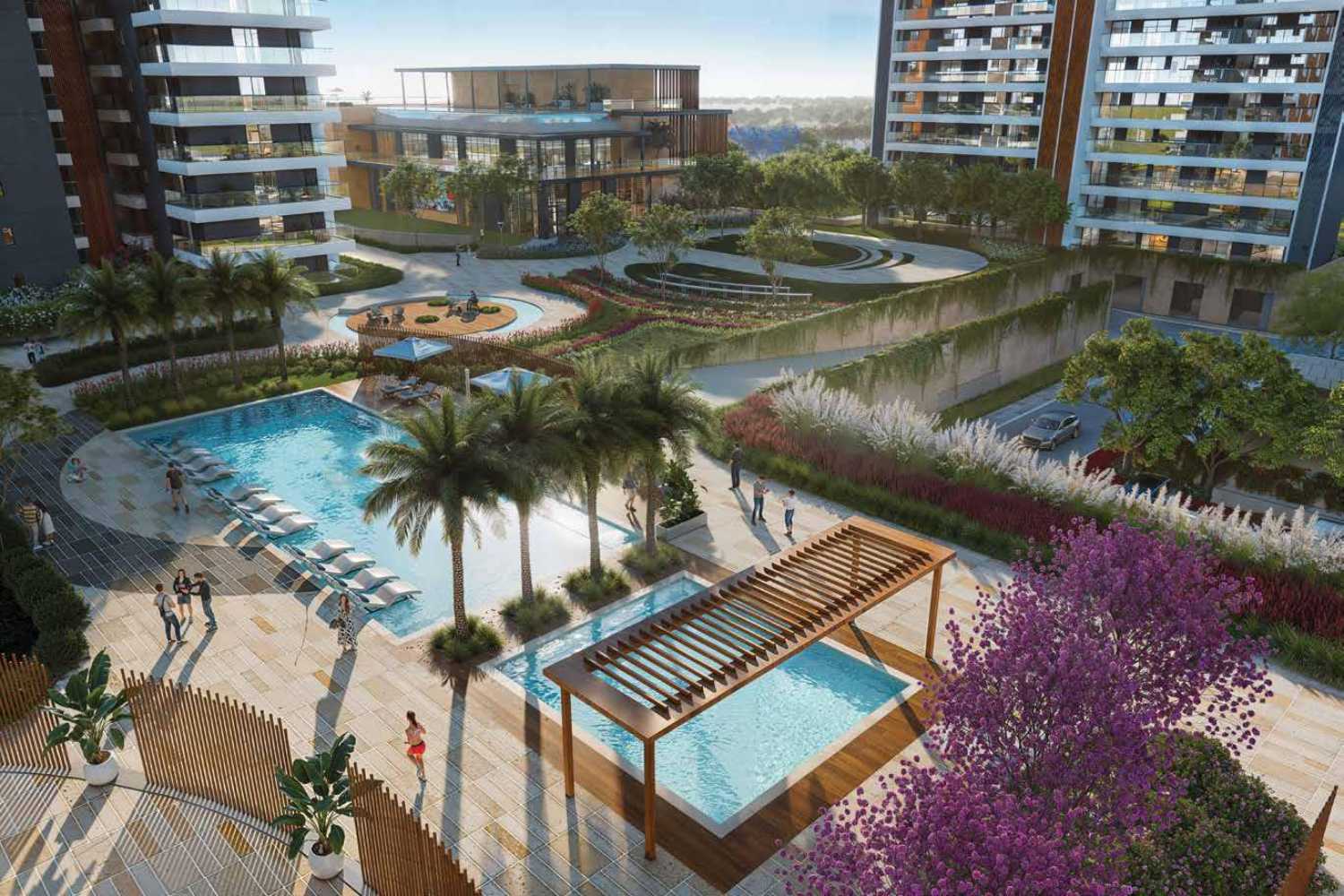

- Luxury Redefined: Spacious 4 BHK apartments, 3.4-meter ceilings, a 1.25 lakh sq ft clubhouse, and 85-88% green coverage make Privana a haven of opulence.

- Prime Connectivity: At the nexus of SPR, NH-48, and Dwarka Expressway, it’s minutes from corporate hubs, top schools, hospitals, and golf courses.

- Investment Goldmine: SPR’s 125% price surge and Privana’s ₹12,790 crore pre-launch sales signal massive appreciation potential in a booming corridor.

- Realty Z Estate’s Expertise: The pros at https://realtyzestate.com offer deep insights into Privana, securing the best prices and exclusive unit allocations to win your investment.

By Team Realty Z Estate | April 6, 2025 | Read Time: ~ 4Minutes

Gurgaon’s real estate scene is a battlefield of ambition, but DLF Privana in Sectors 76 and 77 is charging ahead like a juggernaut, poised to redefine what a luxury township can be. Spanning a colossal 116 acres, this isn’t just another project—it’s a bold vision from DLF Limited, India’s real estate titan, to craft a futuristic enclave that blends opulence, green living, and unmatched connectivity. The buzz is real, with two phases—DLF Privana South and West—selling out in a jaw-dropping 72 hours for over ₹12,790 crore. But is Privana truly the next biggest township in Delhi NCR, or just another shiny promise? Let’s unpack why this sprawling development has everyone talking.

DLF’s Legacy: A Name That Builds Trust

When you’re talking about DLF Limited, you’re talking about a 75-year legacy that’s shaped India’s urban skyline. Founded in 1946 by Chaudhary Raghvendra Singh, DLF started with 22 urban colonies in Delhi before turning Gurgaon into a global hub with projects like DLF Cyber City and DLF Mall of India.

Their residential gems—DLF5 on Golf Course Road, The Crest, and The Arbour—set the gold standard for luxury. With over 340 million square feet developed and a track record of on-time delivery, DLF’s name is a seal of trust. Privana carries this torch, aiming to mirror the iconic scale of DLF5 while pushing the envelope with international architects, sustainable designs, and infrastructure that screams “future-ready.”

BOOK Now – DLF Privana North – Launch Soon

https://realtyzestate.com/project/dlf-privana-north-gurgaon-sector-76/

Continue Reading

- FIIs in the Share Market: Fast Cash, Faster Crashes

- 2022: The Exit Stampede:

- Net Outflow: Rs. 1.21 lakh crore ($14.5 billion) fled Indian equities (ICICI Direct).

- Why?: U.S. Fed rate hikes (75 bps jumps), Russia-Ukraine tensions, and a global risk-off mood pushed FIIs to U.S. treasuries.

- Speed: Stocks liquidity shone sell-offs were executed in minutes, with Rs. 36,117 crore dumped in October alone (Mint).

- Returns: Sensex fell from 61,766 (Jan) to 58,991 (Dec), a ~4.5% dip, with wild swings (e.g., an 8% drop in March).

- 2023: The Comeback Kid:

- Net Inflow: Rs. 1.71 lakh crore ($20.5 billion) returned (Angel One) as India’s GDP grew 7.6% (IBEF).

- Volatility: FIIs flipped net sellers in May (Rs. 25,586 crore out) became net buyers in June (Rs. 26,565 crore in), per IBEF.

- Gains: Sensex soared from ~58,000 to ~66,000 (~14% gain), but risks lingered e.g., Adani’s 2023 crash shaved $150 billion off markets (Groww).

- Flexibility: Daily trades let FIIs chase tech (Rs. 54,757 crore inflow) or ditch financials (Rs. 28,413 crore outflow).

- 2024: Hot and Cold:

- Net Inflow (Partial): $5.38 billion by July 18 (IBEF), but outflows hit five months—Rs.114,445 crore in October (ICICI Direct).

- Why?: Overvalued Nifty (24x P/E vs. 20x historical, Mint), China’s rebound, and U.S. election noise.

- Nature: FIIs yanked Rs. 54,500 crore from financials in October—stocks fluidity let them pivot fast, but losses stung (Sensex down 8% from 85,571 peak).

- FIIs in Real Estate: Slow Build, Big Payoff

- 2022: Solid Ground:

- Total Inflows: $5.88 billion across segments (JLL India); foreign share (FIIs included) at 60% ($3.53 billion).

- Breakdown: Office dominated (40%+ of inflows since 2017, Colliers), warehousing surged (87% foreign-led, Mint), and residential at $650 million (Business Standard).

- Lock-In: Funds tied into projects—e.g., SEZs or housing towers—take 5-10 years to mature or sell.

- Returns: Residential prices rose 4-7% (IBEF), and rentals increased 2-3% (Groww)—steady but not flashy.

- 2023: Momentum Builds:

- Inflows: $5.4 billion, up 10% YoY (Colliers); foreign share at 67% ($3.62 billion).

- Residential Jump: $788.9 million (20% up from 2022), driven by urban demand (Knight Frank).

- Warehousing: $1.2 billion, tied to e-commerce growth (JLL); office steady at $2 billion.

- Fundamentals: RERA enforcement and 3.65 lakh housing units sold (68% YoY growth, IBEF) bolstered trust.

- 2024: Record Smash:

- Total Inflows: $8.87 billion via 78 deals (JLL India), up 51% from 2023; foreign investors at 63% ($5.59 billion).

- Segments: Residential led with 45% ($3.99 billion), warehousing 23% ($2.04 billion), office 28% ($2.48 billion, down 17% from 2023).

- REIT Boom: $800 million (3x 2023’s figure), but exits remain slow—$2.4 billion in platforms locked for 3-5 years.

- Strength: Urbanization (60% urban by 2034, Sobha) and logistics (e-commerce up 25% YoY, IBEF) fuel the fire.

- Real Estate’s Long Game: Why It Outshines Stocks

- Long-Term Lock-In:

- Timeline: Real estate binds capital—construction (3-5 years), leasing/sales (5-10+ years), or REIT exits (years vs. stock seconds).

- Proof: 2024’s $2.4 billion platform deals (JLL) won’t cash out until 2027-2029; a Mumbai tower takes 5 years to build and lease.

- Contrast: FIIs dumped Rs. 42,214 crore stocks in May 2024 (ICICI Direct) but can’t ditch a $1.5 billion warehousing bet (e.g., ADIA-KKR) overnight.

- Real estate’s a vault—lock it in, watch it grow!

- Rock-Solid Fundamentals:

- Drivers: Urban sprawl (Knight Frank: $1.5 trillion market by 2034), rising incomes (6% YoY, IBEF), and logistics (warehousing up 2-3% in 2024).

- Resilience: 2022’s 3.65 lakh housing sales (IBEF), 2023’s $788.9 million residential FII bet, and 2024’s $8.87 billion show unshaken faith.

- Stocks Risk: Sensex’s 70x rise (400 in 1988 to 28,000 in 2017, Groww) came with crashes—20%+ in 2020 vs. real estate’s 50% dip (less severe).

- Policy Boost: RERA cuts fraud, GST streamlines costs—real estate’s backbone grows stronger.

- Exit Hurdles:

- Illiquidity: Selling property or REIT stakes takes months—5% transaction costs (Groww), and market timing slows the process.

- Example: A $500 million office deal (e.g., Brookfield’s Mumbai buy) needs buyers and years vs. stock’s instant Rs. 25,586 crore May 2023 exit.

- Outcome: Forces FIIs to stay put, building value over time—not a panic sell-off.

- Guaranteed Returns:

- Yields: Residential offers 2-3% rentals plus 7-10% appreciation (2022, IBEF); warehousing hits 7-8% (Mint).

- History: A Gurgaon plot from Rs. 8 lakh (1989) to Rs. 4 crore (2017)—50x growth (Groww)—beats Sensex’s 1.5% dividend yield.

- Contrast: Stocks’ 14% 2023 gain (Angel One) can vanish—e.g., 2022’s 4.5% loss or Adani’s $150 billion wipeout.

- Real estate pays slow, but it pays sure!

- Tangible Asset Power:

- Actual Value: Land and buildings endure—2024’s $3.99 billion residential bet banks on India’s housing boom (JLL).

- Hedge: Inflation-proof—property prices rose 7% in 2023 (Knight Frank) vs. stocks’ 20%+ Covid crash.

- Stocks Flaw: Paper gains vanish fast—e.g., Rs. 114,445 crore FII exit in October 2024 (ICICI Direct).

- The Big Picture: Real Estate’s Quiet Triumph

- Share Market Recap:

- Flow: $14.5 billion out (2022), $20.5 billion in (2023), $5.38 billion partial (2024)—total net ~$11.38 billion over three years.

- Style: Quick trades, high returns (14% in 2023), but brutal dips (20%+ drops).

- Real Estate Recap:

- Flow: $5.88 billion (2022), $5.4 billion (2023), $8.87 billion (2024)—a total of $20.15 billion, with $12.74 billion foreign-led.

- Style: Long-term, steady growth—50x over decades vs. stocks’ 70x with higher risk.

- The Edge: Real estate’s $20.15 billion trumps stocks’ $11.38 billion in FII faith, proving its staying power as an honest, return-rich asset.

- Your Move with RealtyzEstate.com

- The Hook: Want to join real estate’s winning streak? RealtyzEstate.com is your expert ally.

- The Expertise: With 15+ years alongside India’s top developers, they guide you to residential, commercial, industrial, and warehousing goldmines—here and abroad.

- The Action: Skip the stock market’s wild ride—connect with RealtyzEstate.com and lock into real estate’s lasting rewards today!

Oberland – Super Luxury Boutique Villa Community near Muktheswar

Escape to Oberland: Your exclusive haven of super luxury boutique villas nestled near Mukteshwar’s tranquility. Experience unparalleled privacy, breathtaking views, and bespoke luxury living. Invest in your dream retreat, where serenity meets sophistication.

Discover meticulously crafted villas designed for ultimate comfort and style, surrounded by nature’s embrace. Secure your slice of paradise in this limited collection of exquisite homes.