Since 2010

Tax Rules 2025-26: Why Selling Property After April 1, 2025, Could Be Your Financial Game-Changer

Tax Rules 2025-26: Why Selling Property After April 1, 2025, Could Be Your Financial Game-Changer

Since 2010

Key Takeaways!

- Deferment Delight: Push your sale past April 1, 2025, and shift tax to FY 2025-26—12 months to strategize!

- Reinvestment Rocks: Section 54 (new homes) and 54EC (bonds) can zap your LTCG tax to zero—up to Rs 10 crore exempt!

- Cash Flow King: Spread tax payments and extend CGAS deadlines to July 31, 2026, for ultimate flexibility.

- LTCG Steady: No tax rule shake-ups in 2025—12.5% or 20% options for pre-July 23, 2024, properties.

- Realty Z Estate’s Call: “This is your real estate market moment—buyers and sellers, lock in these premium perks now!”

By Team Realty Z Estate | March 25 , 2025 | Read Time: ~2 Minutes

Thinking of selling your property? Hold off until April 1, 2025! As of March 31, 2025, tax experts are buzzing about why delaying your real estate sale could unlock serious financial perks. From deferring capital gains tax to supercharging your investment strategy, selling in the new fiscal year (FY 2025-26) offers buyers and sellers a golden window to maximise gains. Team Realty Z Estate breaks down the tax rules, reinvestment hacks, and cash flow tricks that could transform your luxury home sale into a premium profit play!

Why Wait? The Tax Deferment Jackpot Awaits!

- Tax Shift Magic: Sell on March 30, 2025, and your capital gains tax hits in FY 2024-25. Wait one day—April 1, 2025—and it slides to FY 2025-26. That’s a whole year to strategise!

- Expert Scoop: Rahul Singh of Taxmann told Hindustan Times, “The primary advantage is the deferment of capital gains tax. Selling after April 1 gives you a full year to plan tax-saving investments.”

- Cash Flow Win: Spread advance tax over four instalments starting June 15, 2025, instead of a lump sum by March 31, 2025. More breathing room for your wallet!

- CGAS Bonus: Deposit sale proceeds into a Capital Gains Account Scheme (CGAS) by July 31, 2026—not 2025—gifting you an extra year to plot your next property move.

Before vs. After April 1: The Tax Timing Trap

- Pre-April Panic: Sell by March 31, 2025, and you’re locked into FY 2024-25 tax rules. That means rushing to file and pay by July 31, 2025, with less time to dodge the tax bullet.

- Post-April Power: Cross into April 1, and your tax liability shifts to FY 2025-26. You’ve got until July 31, 2026, to park funds in CGAS or reinvest—perfect for real estate buyers eyeing luxury residences!

- Why It Matters: This delay isn’t just procrastination—it’s a calculated play to align your property sale with more intelligent investment options and ease of cash flow.

Reinvestment Hacks: Slash Your Tax Bill to Zero

Continue Reading

- Section

54 Superpower: Reinvest your long-term capital gains

(LTCG) into another residential property under Section 54 of

the Income Tax Act, and kiss your tax goodbye!

- Options

Galore: You can buy a new home one year before or two years after

the sale or build one within three years.

- No

Limits (Almost): Gains up to Rs 10 crore

are exempt if fully reinvested—ideal for premium apartments

in top locations!

- Section

54EC Safety Net: Not into housing? Pump up to Rs

50 lakh of gains into bonds from the National Highways Authority of India

(NHAI) or Rural Electrification Corporation (REC) within six months.

Five-year lock-in, zero tax—done!

- CGAS

Clutch Move: Can’t decide yet? Stash your gains in a

CGAS account by July 31, 2026, and keep your exemption alive while you

hunt for the perfect property.

LTCG Rules 2025: No Change, Big Opportunity!

- Steady

as She Goes: The Income Tax Bill 2025 keeps

long-term capital gains (LTCG) tax on residential properties

unchanged. For homes bought before July 23, 2024, it’s the lower of

12.5% (no indexation) or 20% (with indexation), plus surcharge and cess.

- 24-Month

Mark: Hold your property for over 24

months, and it’s a long-term capital asset—ripe for these tax perks!

- Why

It’s a Win: The tax code does not throw curveballs,

so buyers and sellers can confidently plan, leveraging deferment

and reinvestment to shrink their tax hits.

Cash Flow Smarts: Stretch Your Sale Proceeds

Further!

- Instalment

Ease: Selling after April 1 lets you pay

advance tax in four chunks—June 15, September 15, December 15, and March

15, 2026. No more March-end cash crunch!

- Reinvestment

Runway: That extra year to July 31, 2026, for

CGAS deposits, means you can scout luxury developments

or community residences without

rushing.

- Financial

Flexibility: Spread-out payments and delayed

deadlines align your real estate move with broader investment

goals—think premium housing or market-timing plays!

Micro-Market Boost: Where to Reinvest in 2025-26!

- Mumbai’s Elite: South Mumbai (Malabar Hill, Worli) and Western Suburbs (Bandra,

Juhu) are luxury property hotspots—perfect for Section 54

reinvestment with their prestige and sea views!

- NCR’s Rising Stars: Gurgaon’s Dwarka Expressway (e.g., Westin Residences,

Central Park 104) offers premium apartments with top amenities—a

tax-saving investment dream!

- Why It Works: These locations blend luxury living with high

appreciation, making your reinvested gains work harder in the real

estate market.

The Green Angle: Sustainability Meets Tax Savings!

- Eco-Luxe

Trend: Buyers want green

residences—think

solar panels and rainwater harvesting. Reinvest in sustainable properties

to score tax breaks and eco cred!

- Market

Edge: Projects like Noida’s Max Estate 105 or

Mumbai’s Palais Royale (LEED Platinum) marry luxury with green

vibes—ideal for investment-savvy sellers.

- Future-Proofing: Align your property sale with 2025’s eco-push for a

win-win on tax and resale value!

Risks to Dodge: Don’t Trip Over These Tax Traps!

- Timing

Tangle: Sell too early (before April 1), and

you’ll be stuck with a tighter tax window—plan your sale date like a pro!

- Reinvestment

Rules: Miss the Section 54

(2-3 years) or

54EC (6 months) deadlines, and your gains turn taxable—keep that calendar

handy!

- CGAS

Catch: Funds parked in CGAS must be used

within two years of deposit or taxed in FY 2025-26. Don’t let them sit

idle!

Realty Z Estate’s Expert Playbook: Seal the Deal!

- Global Insight: “Selling after April 1, 2025, is a no-brainer for property

owners,” says Team Realty Z Estate on March 31, 2025. “Defer taxes,

reinvest smartly, and watch your investment soar!”

- Action Plan: Are you eyeing a luxury home in Bandra or a premium

plot in Gurgaon? We’ll guide you to the best locations and

tax hacks—connect with us now!

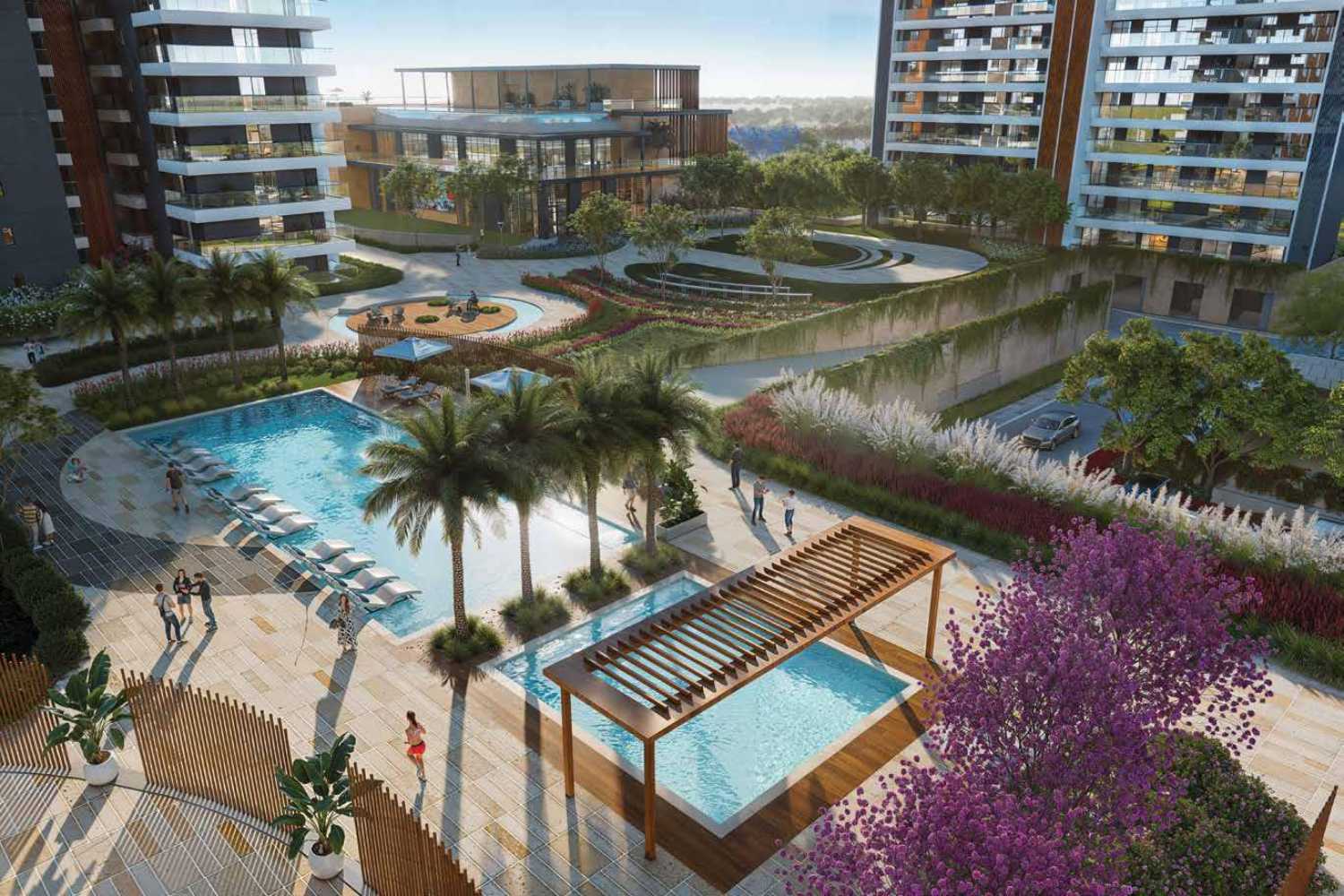

Oberland – Super Luxury Boutique Villa Community near Muktheswar

Escape to Oberland: Your exclusive haven of super luxury boutique villas nestled near Mukteshwar’s tranquility. Experience unparalleled privacy, breathtaking views, and bespoke luxury living. Invest in your dream retreat, where serenity meets sophistication.

Discover meticulously crafted villas designed for ultimate comfort and style, surrounded by nature’s embrace. Secure your slice of paradise in this limited collection of exquisite homes.