Since 2010

Oberoi Realty’s Q4 FY25 Update: Dividend Declared Amid Narrowed Margins

Oberoi Realty’s Q4 FY25 Update: Dividend Declared Amid Narrowed Margins

Since 2010

Key Takeaways!

- Oberoi Realty’s EBITDA margin narrowed to 53.7% in Q4 FY25 from 60% in Q4 FY24.

- Fourth interim dividend of ₹2 per share declared, payable from May 26, 2025.

- Stock rose 2.82% to ₹1,655.65 on BSE, reflecting market confidence.

- Luxury residential and commercial projects drive demand despite cost pressures.

- Realty Z Estate excels in guiding investors through Oberoi’s premium real estate opportunities.

By Team Realty Z Estate | July 22, 2025 | Read Time: ~5 Minutes

Oberoi Realty Ltd, a leading name in India’s luxury real estate market, reported a narrowed EBITDA margin of 53.7% for Q4 FY25, down from 60% in the same quarter last year, reflecting pressures on profitability despite strong project performance. Alongside this, the board declared a fourth interim dividend of ₹2 per equity share (20% of the ₹10 face value) for the quarter ended March 31, 2025, with payment set to begin on May 26, 2025. As of July 22, 2025, Team Realty Z Estate delves into these financial updates, announced after market hours, and their implications for investors and buyers eyeing premium properties in a dynamic real estate landscape.

Oberoi 58 Gurgaon Launch: https://realtyzestate.com/project/oberoi-realty-gurgaon-sector-58/

Financial Snapshot: EBITDA Margin and Market Performance

Oberoi Realty’s EBITDA margin contracted to 53.7% in Q4 FY25 from 60% in Q4 FY24, indicating rising costs or shifting revenue mixes in its luxury residential and commercial projects. Despite this, the company’s stock closed firmly, ending at ₹1,655.65 on the BSE, up ₹45.45 or 2.82% on the results day, signalling investor confidence in its premium portfolio. Oberoi’s focus on high-end developments in Mumbai and emerging markets continues to drive its market resilience, even as margins face pressure.

- EBITDA Decline: 53.7% in Q4 FY25 vs. 60% in Q4 FY24, reflecting cost pressures.

- Stock Strength: ₹1,655.65 close, up 2.82%, post-results.

- Market Context: Robust demand for luxury properties supports share performance.

Continue Reading

BRANDED RESIDENCES I GOLF RESIDENCES I TRENDING PROJECTS I SENIOR LIVING I

Dividend Details: Rewarding Shareholders

The board’s declaration of a ₹2 per share interim dividend

(20% of the ₹10 face value) for Q4 FY25 underscores Oberoi Realty’s commitment

to shareholder value. With a record date of May 5, 2025, and payments starting

May 26, 2025, this move reflects confidence in cash flow stability despite the

margin squeeze. The dividend makes Oberoi an attractive investment for

those seeking returns from a top-tier real estate player.

- Dividend

Amount: ₹2 per share, 20% of ₹10 face value.

- Key Dates: Record

date May 5, 2025; payment from May 26, 2025.

- Investor

Appeal: Signals strong financial health amid market

growth.

Oberoi Realty Gurgaon bookings Opens?

Why Margins Narrowed: A Closer Look

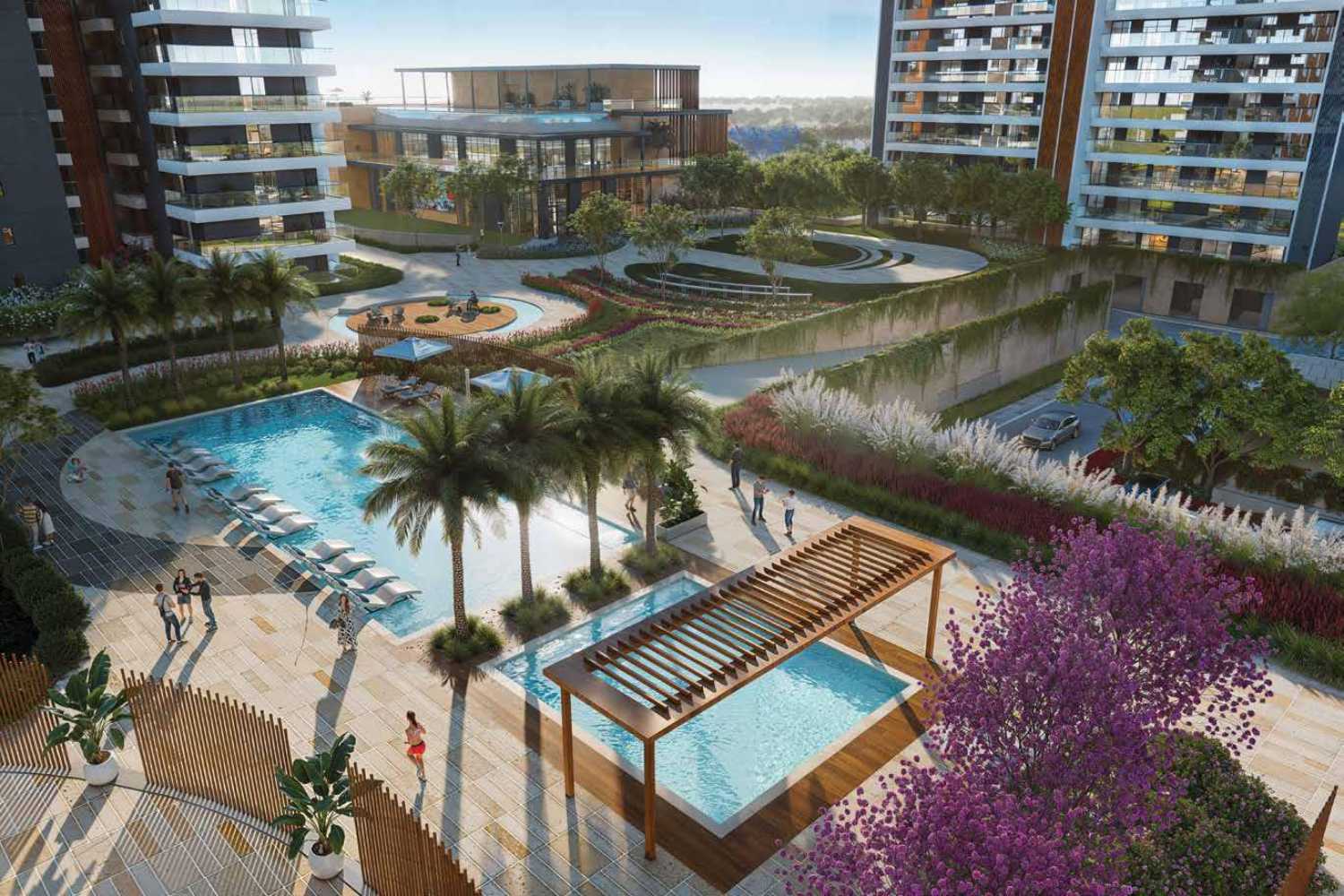

The 6.3% drop in EBITDA margin could stem from higher

construction costs, increased investment in premium amenities,

or a shift toward projects with more extended gestation periods.

Oberoi’s focus on luxury residential towers, such as its

upcoming development in Gurgaon’s Sector 58, often involves high-end

specifications like imported finishes and expansive clubhouses, which elevate

costs but enhance property appeal. Additionally, commercial

ventures in Mumbai’s high-rent markets (e.g., BKC at ₹250/sq. ft.) may

require upfront investments, which can impact short-term margins but

promise long-term gains.

- Cost

Factors: High-end materials and larger amenities raise

expenses.

- Project

Mix: Luxury residential and commercial developments

drive costs.

- Long-Term

Gain: Premium properties ensure sustained market

value.

Implications for Buyers and Investors

For buyers, Oberoi Realty’s luxury projects

remain a beacon of quality, offering residences with unmatched

specifications in prime locations. The margin dip is unlikely to

deter demand, given the company’s track record and the BSE’s positive response.

For investors, the ₹2 dividend and 2.82% stock gain highlight Oberoi’s

stability, making it a compelling choice in a market where demand for

luxury housing is soaring. The company’s strategic investments in

high-growth locations position it to capitalise on India’s real

estate boom.

- Buyer

Confidence: Premium Apartments Retain

Allure Despite Margin Dip.

- Investor

Returns: ₹2 dividend, stock uptick signals a

strong opportunity.

- Market

Trend: Luxury housing demand

fuels Oberoi’s growth.

Oberoi Realty

Golf Course Extension Road Sector 58 Know More

Realty Z Estate’s Take: A Resilient Luxury Leader

“As of July 22, 2025, Oberoi Realty’s Q4 FY25 results, with

a 53.7% EBITDA margin and ₹2 dividend, affirm its strength in the luxury

real estate market,” says Team Realty Z Estate. “Despite margin

pressures, Oberoi’s premium projects and stock performance make

it a top pick for investors and buyers.” We see Oberoi

leading India’s super-luxury housing surge, from Mumbai to

Gurgaon. Ready to invest in or own a dream home with

Oberoi? Connect with Realty Z Estate for exclusive insights and guidance!

Read More: https://realtyzestate.com/can-you-believe-it-the-costliest-trump-tower-in-india-is-coming-to-noida/

Oberland – Super Luxury Boutique Villa Community near Muktheswar

Escape to Oberland: Your exclusive haven of super luxury boutique villas nestled near Mukteshwar’s tranquility. Experience unparalleled privacy, breathtaking views, and bespoke luxury living. Invest in your dream retreat, where serenity meets sophistication.

Discover meticulously crafted villas designed for ultimate comfort and style, surrounded by nature’s embrace. Secure your slice of paradise in this limited collection of exquisite homes.