Since 2010

Indian Economy Dead? Rs 100 Crore Homes Selling Like Hot Pan Cakes

Indian Economy Dead? Rs 100 Crore Homes Selling Like Hot Pan Cakes

Since 2010

Key Takeaways!

- Luxury Surge: Homes above Rs 4 crore saw 75% sales growth in 2023, 53% in 2024; 49 Rs 100 crore+ deals worth Rs 7,500 crore.

- Top Cities: Mumbai (69% of ultra-luxury sales), Delhi-NCR, Bengaluru, Hyderabad, Pune drive 80% of luxury housing demand.

- Global Investments: Indian HNIs buy premium properties in London, Dubai (15% of 2024 luxury sales), and New York.

- Branded Residences: Projects like Westin Residences, M3M Jacob & Co, and Sobha Aranya redefine luxury with global appeal.

- Market Outlook: USD 45 billion market in 2024 to hit USD 105 billion by 2030; verify RERA, approvals for secure investments.

India’s luxury real estate market is thriving, defying any notion of economic slowdown, with super-luxury homes priced above Rs 100 crore selling at an unprecedented pace. Over the past 2-3 years, the surge in high-end property sales, driven by affluent buyers, Non-Resident Indians (NRIs), and robust infrastructure growth, has reshaped the real estate landscape. From Mumbai’s iconic skyline to emerging hubs like Hyderabad, luxury residences are redefining wealth and lifestyle. Indian buyers are also making waves globally, snapping up premium properties in cities like London and Dubai. As of August 3, 2025, this article explores the luxury real estate boom, key projects, and investment opportunities for buyers and investors.

Continue Reading

Unprecedented Growth in Luxury Real Estate

The Indian super luxury real

estate market has witnessed explosive growth, with sales of homes

priced above Rs 4 crore surging 75% in 2023 and 53% in 2024, totalling 19,700

units across seven major cities—Mumbai, Delhi-NCR, Bengaluru, Hyderabad,

Pune, Chennai, and Kolkata. The ultra-luxury segment, homes priced above Rs 100

crore, recorded 49 deals worth Rs 7,500 crore over three years, with Rs 3,652

crore in 2024 alone. Mumbai dominates with a 69% share of these

transactions, followed by Delhi-NCR at 31%. The market size, valued at

USD 45 billion in 2024, is projected to reach USD 105 billion by 2030,

expanding at a 15% CAGR. This growth reflects a shift toward premiumisation,

with luxury housing comprising 21% of the market in 2024,

up from 7% in 2019.

- Mumbai’s Lead: 34

of 49 Rs 100 crore+ deals, with Worli and Malabar Hill fetching Rs 200-500

crore.

- Delhi-NCR’s Surge: Gurugram’s super-luxury projects drive sales, with

10,500 units sold in 2024.

- Market Momentum: Luxury

homes (Rs 4 crore+) made up 41% of 2024 sales, up from 30% in 2023.

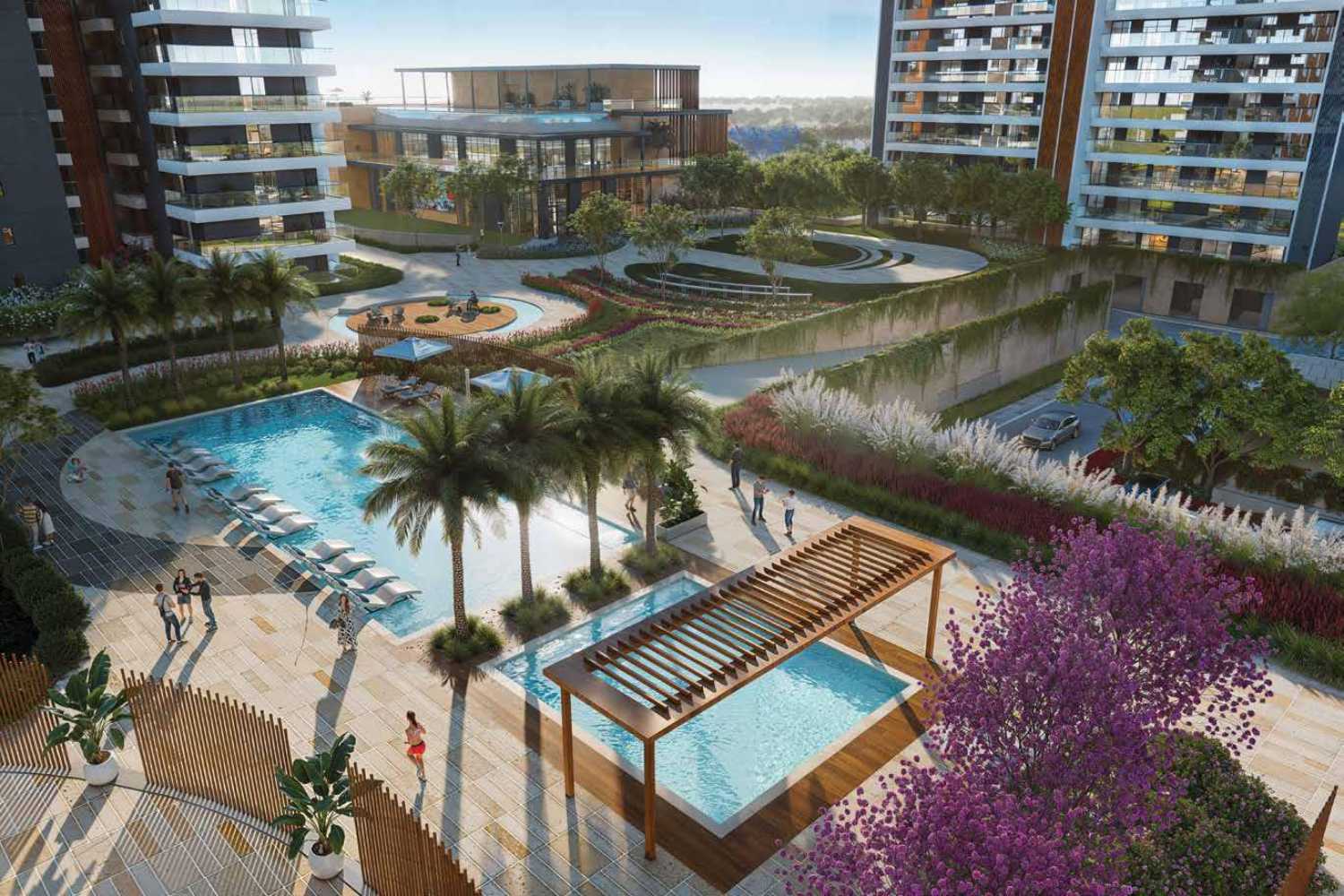

Spotlight on Super-Luxury Projects

India’s super-luxury market

is defined by marquee projects from top developers, showcasing

global-standard amenities and prime locations:

- DLF The Camellias,

Gurugram: Launched in 2014, this project set a benchmark with a 16,290

sq. ft. penthouse sold for Rs 190 crore in 2024 at Rs 1.05 lakh/sq. Ft.,

with units ranging from 7,600 sq. ft. (Rs 65 crore) to 10,600 sq. ft.

- DLF The Dahlias, Gurugram: Launched in 2024, this 17-acre development

offers 420 apartments (10,600–16,000 sq. ft.) averaging Rs 100

crore/unit, with a revenue potential of Rs 35,000 crore.

- Oberoi Three Sixty West,

Mumbai: A

5,395 sq. ft. apartment in Worli sold for Rs 60 crore in 2025,

featuring sea-facing residences with premium amenities.

- Godrej Connaught One,

Delhi-NCR:

Launched in 2022, this 7 lakh sq. ft. high-rise near Connaught Place

offers luxury apartments with boutique clubhouses and air

purifiers.

- Westin Residences, Sector

103, Gurgaon:

Developed by Whiteland Corporation, this project offers hotel-style

luxury apartments with concierge services, priced from Rs 7

crore.

- M3M Jacob & Co, Noida: A collaboration with Jacob & Co, this development

features ultra-luxury residences with exquisite designs, starting

at Rs 8.5 crore.

- Smartworld Elie Saab, Noida: This

project by Smartworld Developers and Elie Saab offers

Mediterranean-inspired homes with opulent amenities, priced

from Rs 8.5 crore.

- Sobha Aranya, Sector 80, Gurgaon: Sobha’s luxury project features golf-view apartments

with world-class amenities, starting at Rs 7 crore.

- Gaur Islands, Greater

Noida: Developed by Gaur sons, this project offers luxury

villas and apartments with water features and green spaces, priced

from Rs 5 crore.

These projects highlight

the market’s shift toward branded residences and lifestyle-driven

communities, catering to buyers seeking exclusivity and investment

potential.

Indians Buying Luxury Homes Globally

Indian high-net-worth

individuals (HNIs) and ultra-high-net-worth individuals (UHNIs) are expanding

their real estate portfolios globally, targeting premium

properties in top-tier cities. In London, buyers are drawn to

Mayfair and Knightsbridge, where properties range from £5 million to £20

million, driven by education and

business needs. Dubai’s Palm Jumeirah and Downtown are hotspots, with Indians

accounting for 15% of luxury home sales in 2024. New York’s Manhattan

penthouses also attract Indian investors for second homes and investment

diversification. This global trend, fuelled by a 51% growth in India’s HNI

population in 2024 (Hurun), complements the domestic luxury market’s

strength.

- London: Indian buyers target Mayfair for

£5-20 million properties.

- Dubai: 15% of luxury home sales to

Indians in 2024, per Knight Frank.

- New York: Manhattan penthouses draw Indian HNIs

for investment.

Factors Driving the Luxury Surge

Several forces are propelling

India’s luxury real estate boom:

- Rising Wealth:

India’s HNI and UHNI population grew 51% in 2024, per Hurun, driving

demand for premium properties as lifestyle statements.

- Lifestyle Shifts: Younger buyers prioritise low-density homes with amenities

like private pools and green terraces, per Knight Frank’s Luxury Outlook

Survey 2023.

- NRI Investments: NRIs invested $13.1 billion in Indian real estate in 2023,

targeting luxury homes for returns and cultural ties, per

Forbes India.

- Infrastructure Growth:

Projects like Mumbai’s Coastal Road and Noida International Airport boost property

values in prime locations.

- Branded Residences:

Collaborations with global brands like Westin, Jacob & Co, and Elie

Saab elevate market appeal.

Investment Opportunities and

Advice

For buyers and investors

eyeing India’s luxury real estate:

- Focus on Prime Locations: Mumbai (Worli, Malabar Hill), Delhi-NCR (Gurugram), and Bengaluru

(Whitefield) offer high appreciation potential, with property

prices rising 10-34% YoY, per Anarock.

- NRI Strategy: Invest in emerging luxury hubs like Hyderabad and Pune for

strong returns, with Hyderabad’s premium segment growing 20% in

2024.

- Due Diligence: Verify developer credentials, RERA registration, and project

approvals to ensure secure investments.

- Branded Residences: Prioritise projects like Westin Residences and M3M Jacob

& Co for global appeal and resale value.

- Long-Term Gains: Luxury properties offer robust returns,

with some markets seeing 15-20% annual growth.

Realty Z Estate’s Take

India’s luxury real

estate market is a powerhouse, with Rs 100 crore homes selling like

hot cakes,” says Team Realty Z Estate. “From Mumbai’s branded residences to global markets

like Dubai, we guide buyers and investors to seize premium

opportunities.” With our expertise in

navigating super-luxury projects, connect with us for tailored

insights and investment strategies!

https://www.youtube.com/@RealtyZEstate/shorts

Oberland – Super Luxury Boutique Villa Community near Muktheswar

Escape to Oberland: Your exclusive haven of super luxury boutique villas nestled near Mukteshwar’s tranquility. Experience unparalleled privacy, breathtaking views, and bespoke luxury living. Invest in your dream retreat, where serenity meets sophistication.

Discover meticulously crafted villas designed for ultimate comfort and style, surrounded by nature’s embrace. Secure your slice of paradise in this limited collection of exquisite homes.