Since 2010

10 Countries Where Buying a Home Is Almost Impossible: A Real Estate Nightmare Unveiled

10 Countries Where Buying a Home Is Almost Impossible: A Real Estate Nightmare Unveiled

Since 2010

Key Takeaways!

- Sky-High Prices: Hong Kong leads with properties at $25,000 per square metre, a far cry for most buyers.

- Urban Crunch: Singapore and Japan have luxury residences averaging $1.5 million and ¥ $60 million, squeezed by land scarcity and market heat.

- Foreign Push: Switzerland and Australia battle surges—Zurich at $1 million, Sydney at $1.5 million—driven by overseas investment bloating real estate.

- Policy Struggles: Canada and the UK wrestle with housing costs (Vancouver at CAD 1.2 million, London at £500,000) despite cooling attempts.

- Realty Z Estate’s View: “These locations flaunt premium markets—buyers need sharp investment moves to break into this real estate elite!”

By Team Realty Z Estate | April 3, 2025 | Read Time: ~2 Minutes

Dreaming of a cosy home? In these 10 countries, that dream’s a wallet-crushing fantasy! From astronomical property prices to land shortages, real estate here is a playground for the ultra-wealthy. Buyers face a steep climb, whether it’s luxury apartments or basic residences. Here’s the jaw-dropping scoop as of April 3, 2025!

1. Hong Kong: The Priciest Plot on Earth!

- Skyrocketing Costs: At $25,000 per square metre, Hong Kong’s real estate is untouchable for most buyers.

- Why So High?: Scarce land, fierce demand, and foreign investment catapult property prices skyward.

- Public Housing Clue: Over 50% live in government flats, a sign of this market’s exclusivity!

2. Singapore: Island of Impossible Dreams!

Continue Reading

- Million-Dollar Madness: Private residences average $1.5 million, locking out locals in this sleek location.

- Subsidised Squeeze: 80% rely on public housing, but even those apartments aren’t cheaper!

- Land Limits: A growing population and tiny terrain make this market a luxury stronghold!

3. Switzerland: Alpine Heights, Alpine Prices!

- Millionaires’ Haven: Zurich and Geneva homes breach $1 million, drawing global investors.

- Price Leap: A 30% surge in five years, says the Swiss National Bank, sidelines local buyers.

- Rule Roadblocks: Strict non-resident buying laws add spice to this premium housing stew!

4. Australia: Down Under’s Price Surge!

- Sydney’s Stunner: Properties hit $1.5 million, crushing first-time buyers’ hopes.

- Foreign Flood: Overseas cash pumps up the market, with 40% feeling housing is a lost cause.

- Policy Puzzles: Government tweaks can’t bridge the income-home gap in this development hub!

5. New Zealand: Kiwi Costs Out of Control!

- Auckland’s Affordability Woe: Homes average NZD 1.2 million, among the world’s toughest locations.

- Youth Stalled: Young buyers rent or stay home, per a decade of Reserve Bank data.

- Supply Snag: Affordable housing efforts lag, keeping the market locked tight!

6. Canada: Northern Dreams, Sky-High Prices!

- Vancouver’s Vault: Properties top CAD 1.2 million, a North American market monster.

- Hopeless Horizons: 30% of Canadians doubt owning a residence fueled by foreign cash.

- Cooling Chaos: Government reins can’t tame this real estate beast for buyers!

7. United Kingdom: London’s Lofty Lockout!

- Capital Crunch: London homes average £500,000, a hurdle for young pros in this location.

- 20% Rise: Prices have soared since 2015, per the Office for National Statistics, choking market entry.

- Shared Solutions: Buyers lean on shared ownership to crack this housing nut!

8. Japan: Tokyo’s Towering Trouble!

- Urban Price Peak: Tokyo properties hit ¥60 million, while rural homes sit cheap—buyers lose either way!

- Youth Out: Over 40% of young Japanese see no residence in their future, surveys say.

- Aging Anchor: A shrinking populace stalls the market, toughening investment odds!

9. France: Parisian Prices Soar!

- €10,000 Per Metre: Paris apartments dazzle at this rate, a European luxury leader.

- Decade of Drift: Per stats, a 30% price hike in 10 years pushes buyers to rentals or fringes.

- Supply Starved: Government aid can’t match demand, making housing a premium prize!

10. Sweden: Stockholm’s Steep Standoff!

- SEK 5 Million Barrier: Stockholm properties block young buyers in this fierce market.

- Studies reveal that half in Doubt: 50% of Swedes see homeownership fading.

- Policy Push: Affordable housing plans stumble as demand outruns supply in this development race!

Realty Z Estate: Your Global Property Saviour!

Are you eyeing luxury homes in these challenging markets? Realty Z Estate, the world’s slickest real estate consultancy, lights your way! From Hong Kong’s peaks to Sweden’s streets, they turn properties into your next residence, apartment, or investment coup. Reach out now!

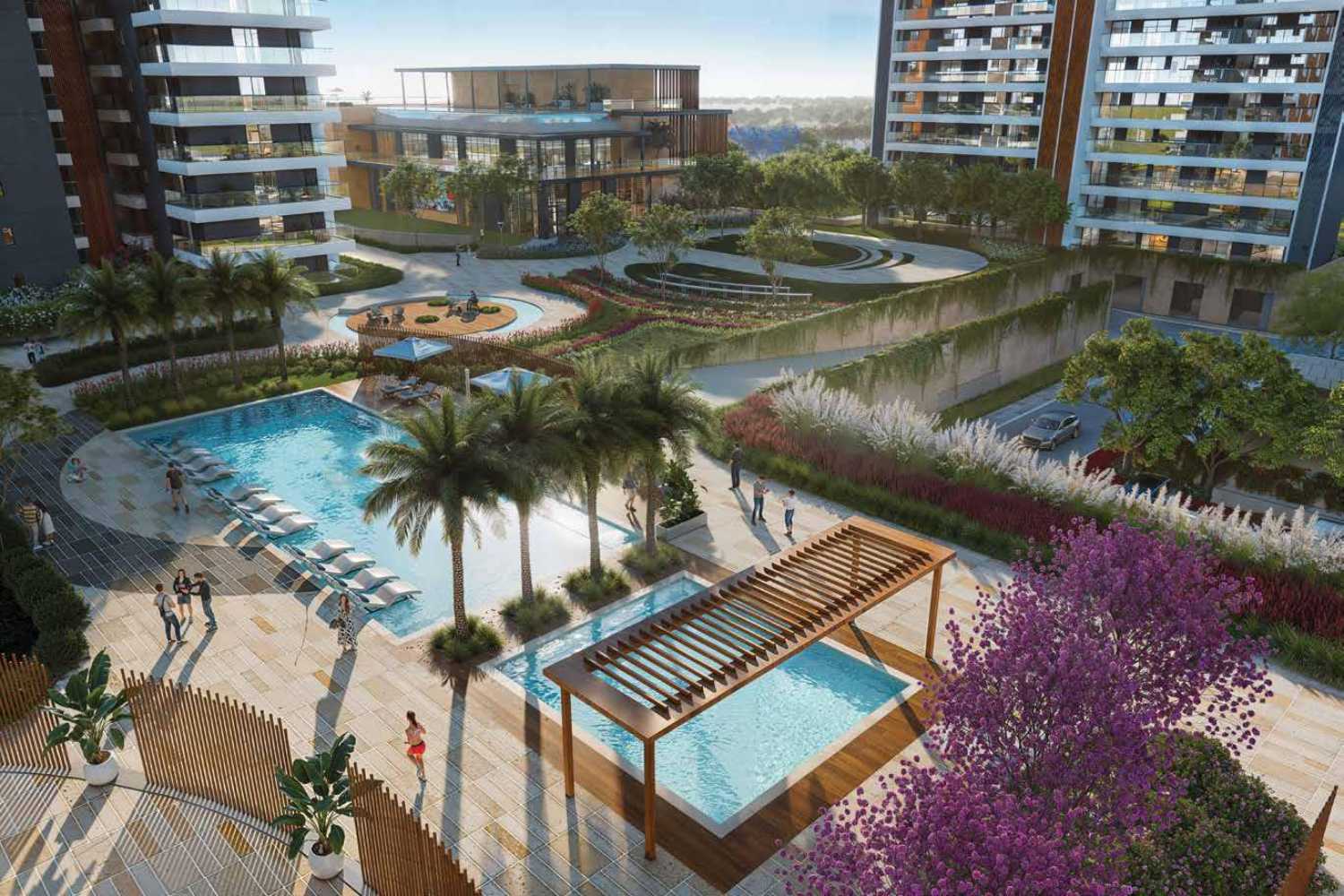

Oberland – Super Luxury Boutique Villa Community near Muktheswar

Escape to Oberland: Your exclusive haven of super luxury boutique villas nestled near Mukteshwar’s tranquility. Experience unparalleled privacy, breathtaking views, and bespoke luxury living. Invest in your dream retreat, where serenity meets sophistication.

Discover meticulously crafted villas designed for ultimate comfort and style, surrounded by nature’s embrace. Secure your slice of paradise in this limited collection of exquisite homes.